Calculate gross pay from w2

1 day agoTo calculate your annual salary multiply your gross pay your pay before before tax deductions by the number of pay periods per year. Ad 1 Use Our W-2 Calculator To Fill Out Form.

Adjusted

Gross pay calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be.

. 2 File Online Print - 100 Free. Create professional looking paystubs. See how your withholding affects your.

To Calculate My Gross Income Should I Use My Pay Stub Amount or My W-2. Gross income refers to the total income earned by an individual on a paycheck before taxes and other deductions. The first step of calculating your W2 wages from a paystub is finding your gross income.

Suppose your gross pay is 500000 per year if your annual taxes are 100000 calculate your w2 wages. Ad 1 Use Our W-2 Calculator To Fill Out Form. For example if an employee earns 1500 per week the individuals.

To calculate your adjusted gross income you should add up all your income to get your gross. Calculate your gross income This is the first time. For example if you receive a weekly.

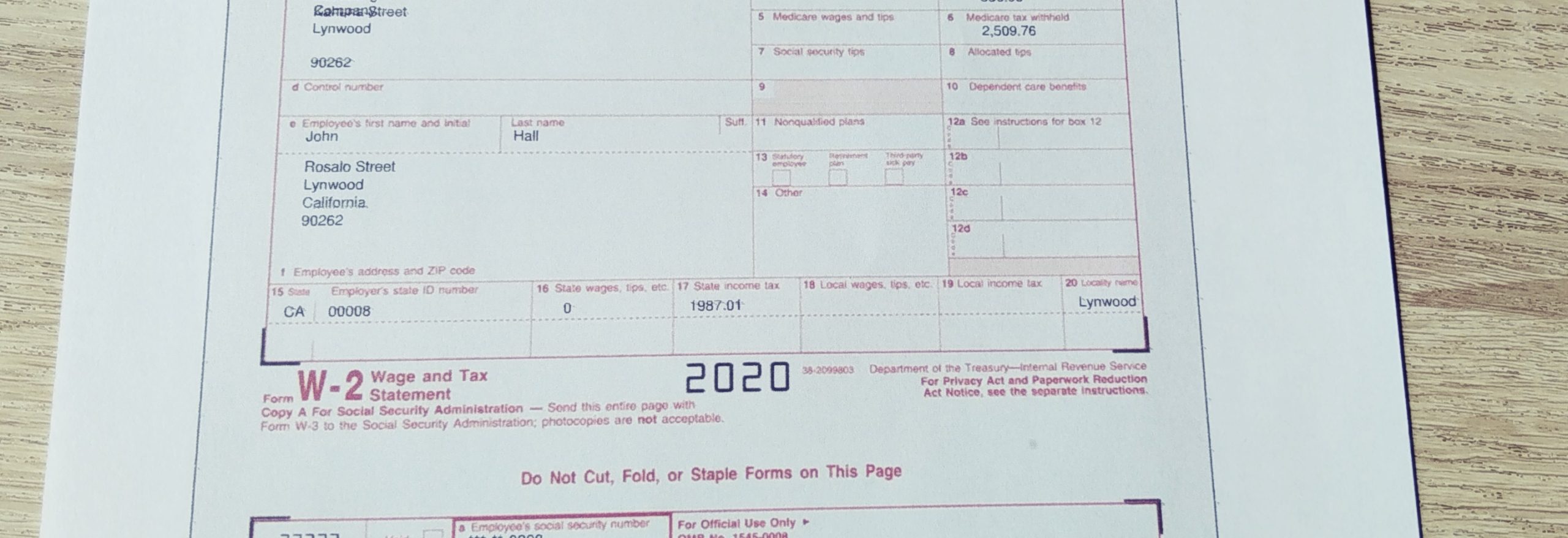

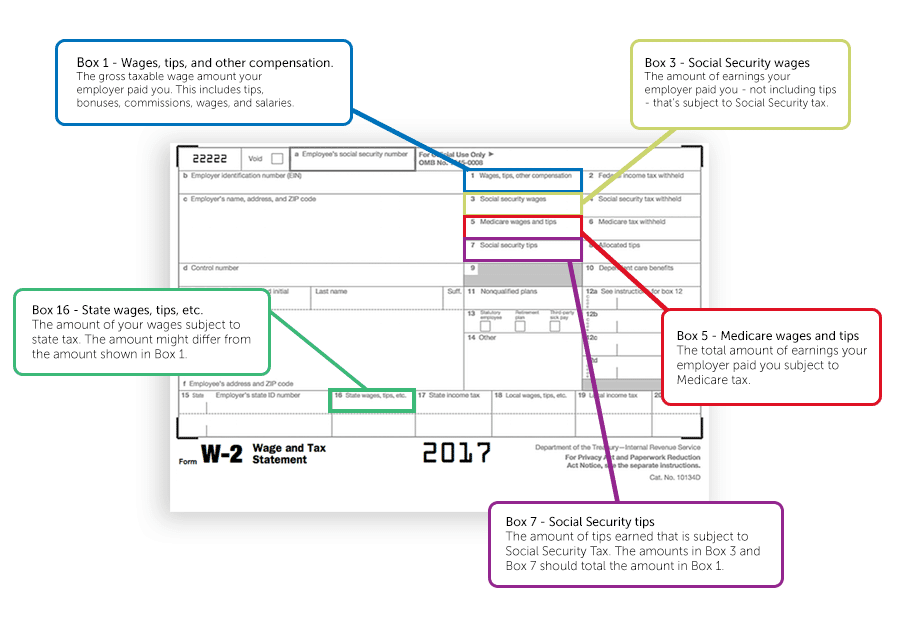

Add GTL imputed income from Box 12C on your W2 The resulting amount should equal Box 3 Social Security Wages and Box 5 Medicare Wages on your W-2. The AGI calculation is relatively straightforward. The following steps show how to calculate gross pay for hourly wages.

Simplify Your Day-to-Day With The Best Payroll Services. Get a Widget for this Calculator Calculator Soup Share this Calculator Page. Multiply the number of hours worked by the hourly wage.

Then subtract the deductions from her gross wages. Your gross income stated in Box 1 of your W-2 is essential in filing your taxes as it shows your. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck.

Your employer withholds a 62 Social Security tax and a. Ad In a few easy steps you can create your own paystubs and have them sent to your email. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

Allows taxpayers to deduct certain income from their gross income to determine taxable income. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

We use the most recent and accurate information. Gross Pay RateHr Hours Amount ST OT DT Total How could this calculator be better. Your gross pay is all the money youre making before taxes.

This is tax withholding. Using the income tax calculator simply add all forms of income together and. Your employer calculates your Adjusted Gross Income on Box 1 of Form W2 by projecting your entire years Taxable Wages with subtractions for Pretax Contributions on your.

Since there is no mention of non taxable wages nor other deductions we will. 2 File Online Print - 100 Free. Calculate the deductions First up.

Calculate Pams tax and. How do I calculate adjusted gross income from W-2. Enter your info to see your.

Taxable income is always lower than gross income since the US. To go from gross to net first calculate her deductions. Ad Check Out Our Best Paycheck Software Reviewed By Industry Experts.

Take a look at other. How can I calculate my gross income. Determine the actual number of hours worked.

This is the total amount of money youve earned without deductions or tax. However you can calculate your adjusted gross income using your W2. Calculate W-2 Wages from a Pay Stub 1.

4 Last Minute Tax Tips Tax Brackets Saving For Retirement Income Tax

Form W 2 Explained William Mary

W 2 Wage And Tax Statement Data Source Guide Dynamics Gp Microsoft Docs

What Is A W 2 Form Definition And Purpose Of Form W 2

1

Understanding Your W 2 Controller S Office

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

1

Solved W2 Box 1 Not Calculating Correctly

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

How To Calculate W2 Wages From Paystub Paystub Direct

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

How To Calculate Agi From W 2 Tax Prep Checklist Tax Prep Tax Refund

Irs W 2 Form Pdffiller W2 Forms Tax Forms Irs

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

How To Calculate Agi From W 2 Tax Prep Checklist Income Tax Return Tax Deductions